Navigating Aluminum Packaging Tariffs: What Importers Need to Know

If your business relies on aluminum trays, containers, or foil for food service or CPG packaging, tariffs can be a hidden threat to your bottom line. With global trade shifts, price volatility, and evolving import laws, understanding the aluminum tariff landscape is essential, especially for importers, procurement teams, and private label brands.

In this guide, we break down what aluminum packaging tariffs are, how they affect your business, and how Wyda helps you stay compliant, competitive, and stocked.

What Are Aluminum Packaging Tariffs?

Aluminum tariffs are import taxes imposed by the U.S. government on certain aluminum products, including raw materials and finished goods like food containers and foil trays.

There are three main types of tariffs importers should be aware of:

Section 232 Tariffs: A 10% tariff on aluminum imports from many countries, introduced in 2018 under national security concerns.

Anti-Dumping Duties (ADD): Applied when foreign manufacturers sell aluminum products in the U.S. at unfairly low prices.

Countervailing Duties (CVD): Imposed when foreign governments subsidize aluminum production, creating unfair competition.

These tariffs are enforced by U.S. Customs and Border Protection (CBP) and can significantly increase your landed cost if not accounted for properly.

Countries Affected by U.S. Aluminum Tariffs

As of 2025, the following countries are subject to various aluminum-related tariffs:

China: Subject to both ADD and CVD on many aluminum products

Russia: Broad sanctions and tariffs on metals

India: Tariffs on specific aluminum categories

United Arab Emirates: Section 232 tariffs reinstated in 2021

Vietnam, Indonesia, and others: Under investigation or partial restrictions

For the latest updates, refer to the U.S. International Trade Commission HTS Database.

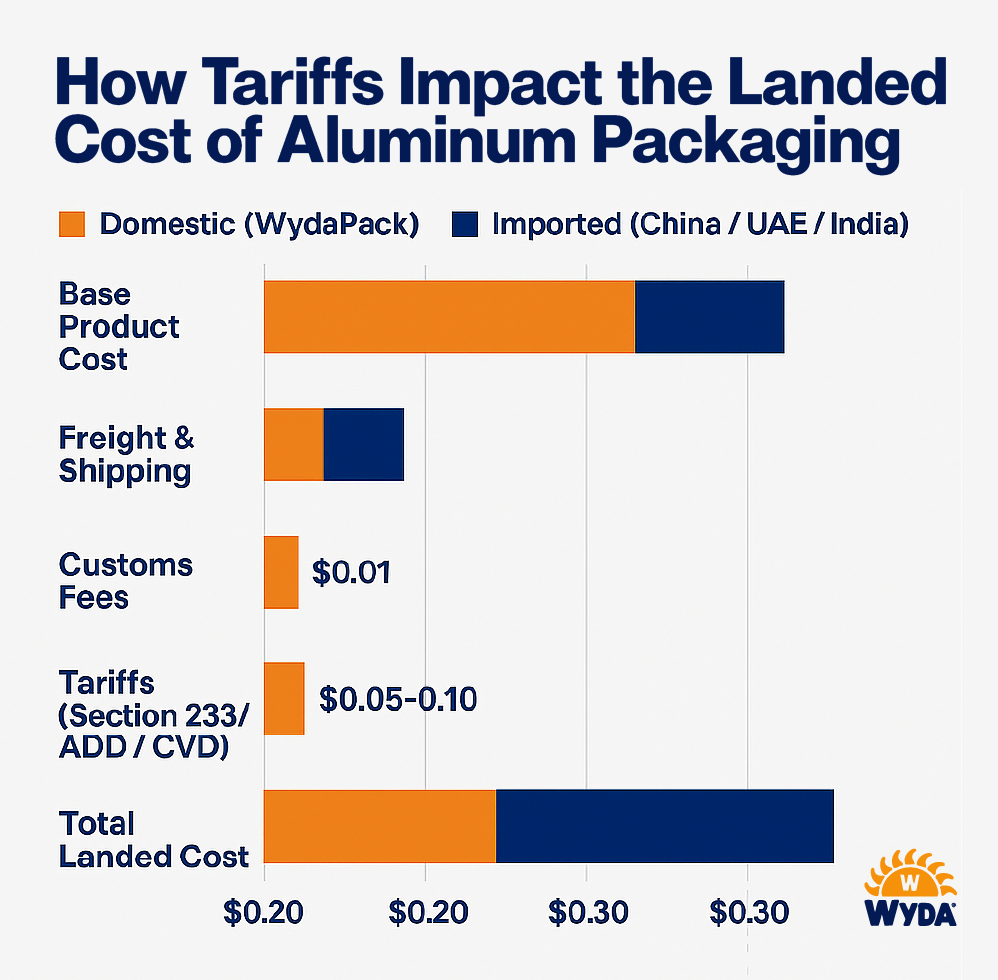

How Tariffs Impact Food Packaging Costs

Tariffs can add 10%–25% or more to the cost of imported aluminum packaging. These hidden costs often show up after customs clearance not on the initial invoice, making them difficult to forecast and easy to overlook. This impacts several key areas of your operation:

Per-unit cost of aluminum trays, containers, and foil lids

Freight and logistics planning, especially for time-sensitive shipments

Retail and wholesale pricing models, particularly for co-packing or private label programs

Profit margins for both private label brands launching in retail and food service distributors operating on tight bulk pricing

If you're currently importing aluminum packaging from Asia, the Middle East, or any country subject to Section 232, ADD, or CVD tariffs, you're likely either overpaying or at risk of supply chain disruption. These unpredictable costs can delay launches, strain vendor relationships, and eat into margins, especially if you're in the early growth stages or working with big-box partners where pricing flexibility is limited.

By working with a domestic aluminum packaging supplier like Wyda, you avoid these risks entirely while gaining reliable lead times, consistent pricing, and a direct line to customer support.

Strategies to Reduce Tariff Exposure

Work with a Domestic Supplier

The most effective way to avoid aluminum tariffs is to source from a domestic or tariff-exempt supplier. Instead of navigating volatile trade policy, unexpected customs fees, and international shipping delays, you gain cost certainty, supply chain control, and peace of mind.

Wyda manufactures and distributes aluminum packaging from within North America, which means our customers never deal with Section 232 tariffs, anti-dumping duties, or overseas freight headaches.

Benefits of Working with a Domestic Aluminum Packaging Partner:

1. Predictable Costs

No hidden customs charges, no currency exchange risks, and no tariff surcharges. What you’re quoted is what you pay.

2. Faster Lead Times

Get your wholesale aluminum food packaging delivered quickly, without waiting on container ships or overseas production cycles.

3. Simplified Logistics

Ship from our North American warehouse network directly to your distribution center, co-packer, or facility without involving customs brokers or port delays.

4. Easier Communication & Support

Work in your time zone, with real people who understand your industry. Whether you're running a private label CPG brand or a large-scale food service operation, our team helps you plan ahead, stay stocked, and scale smoothly.

5. Flexibility & Customization

Need to tweak a tray design or update your packaging mix? We can work closely with you to create custom aluminum containers that align with your brand and your operational needs without the long lead times and rigid MOQs of offshore suppliers.

6. Compliance Peace of Mind

No need to worry about misclassified HTS codes, changing duties, or delayed clearances. We’ve engineered our operation around U.S. regulations and supply chain requirements.

7. Supports Sustainability Goals

Our recyclable aluminum products are produced closer to your operations, reducing the carbon footprint associated with long-distance freight and supporting your ESG initiatives.

Understand HTS Codes and Classifications

One of the most common-and costly-mistakes importers make is misclassifying their aluminum packaging. The Harmonized Tariff Schedule (HTS) is used by U.S. Customs and Border Protection (CBP) to determine tariff rates, import eligibility, and compliance requirements for all imported goods. If you assign the wrong code or use vague product descriptions, you could unknowingly trigger Anti-Dumping Duties (ADD) or Countervailing Duties (CVD)-leading to surprise costs or even customs delays.

Why HTS Code Accuracy Matters:

Incorrect HTS codes can result in overpaying tariffs, underpaying duties (which leads to audits or penalties), or being denied entry altogether.

Ambiguous or misaligned product descriptions raise red flags at customs and may prompt a manual review, delaying your shipment.

Some aluminum products like foil containers, multi-compartment trays, or specialty food packaging-may fall under different classifications depending on how they’re labeled or intended to be used.

How to Avoid Costly Mistakes:

We strongly recommend working with a licensed customs broker or international trade compliance consultant to ensure:

Your products are classified under the correct HTS codes

The commercial invoice, bill of lading, and packing list use clear, accurate descriptions that align with the selected codes

You’re not accidentally subject to ADD/CVD orders, especially when sourcing from high-risk countries like China or Vietnam

Additionally, use the U.S. Harmonized Tariff Schedule Search Tool to double-check classifications or consult the CBP Importing Guide (PDF) for detailed best practices.

Pro Tip:

Don’t rely solely on your supplier’s classification. Many overseas vendors will list incorrect or incomplete HTS codes to avoid duties, but you're the one legally responsible once it hits U.S. customs.

By taking the time to validate your HTS codes and documentation up front, you avoid costly missteps that can undermine your margins and delay your product from reaching customers.

How Wyda Helps You Avoid Tariff Risk

Wyda is a North American-based aluminum packaging supplier that helps food brands and distributors avoid the uncertainty of overseas imports.

Here’s how we support you:

Domestic manufacturing and warehousing = no Section 232 tariffs

Fast lead times and consistent inventory

Custom aluminum trays and foil containers for private label and food service

Sustainable, recyclable packaging that meets growing retailer and consumer expectations

Dedicated account support to help you scale without supply chain risk

Whether you're a meal kit brand, catering company, or CPG manufacturer, Wyda provides tariff-free packaging solutions that protect your margins and simplify your operations.

Secure Your Supply Chain with Confidence

Aluminum tariffs are here to stay and the risk of cost spikes, delays, and compliance issues is real. The smartest move? Partner with a domestic supplier who understands your industry and can deliver at scale.

Wyda helps you:

Eliminate tariff exposure

Streamline your packaging supply chain

Customize trays and containers to fit your brand

Meet sustainability goals with recyclable aluminum